Gyms are bustling with customers and confidence. Capacity is nearing 2019 levels, users are ditching at-home workouts for studio fitness and well-financed operators are eyeing up struggling competitors.

Inspired by Peloton’s success during the pandemic, big, low-cost gyms are moving into tech as they spy a chance to stand out from rivals.

Hans van der Aar, chief financial officer of Basic-Fit, Europe’s largest gym operator with 1,015 outlets in France, Spain, the Netherlands, Belgium and Luxembourg, says gymgoers “now want everything” with tech shaping a “hybrid” sector where users can access fitness “everywhere”.

The “logical step” for Basic-Fit, he said, was to launch its own video-connected bike, with a trial next year and a wider rollout in 2023. UK market leader PureGym plans a similar launch next year, a source close to the company said.

But while gyms and studios have filled up, Peloton subscribers have used their at home equipment less and less, dropping from 26 to 16 workouts a month per premium subscription in the space of six months.

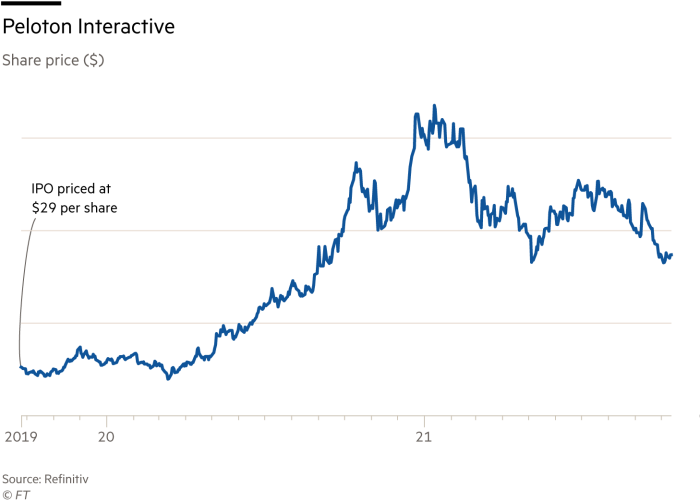

This month Peloton shed nearly $11bn in a week in market value after cutting revenue forecasts. Its shares are down roughly 70 per cent since the start of the year, when it was valued at $49bn. The company last week announced a $1bn equity raise to increase liquidity having burnt through $650m in its first quarter.

The maker of NordicTrack treadmills, last month shelved an IPO that was meant to raise more than $700m for the company, citing “adverse market conditions”.

While the market cools on connected fitness, the opportunity to innovate and expand is there for “an emerging Champions League of gyms”, said Humphrey Cobbold, chief executive of PureGym, referencing large players such as Basic-Fit, US-market leader Planet Fitness, PureGym and Smart Fit, a chain across Latin America.

“We can invest more in tech, the quality of our equipment and give access to more content at lower prices. Scale brings advantages”, he said.

“These tech offerings, such as at-home classes, connected equipment and apps, were secondary to the in-person experience, said Erica van Vonderen-Hahn, chief commercial officer at Basic-Fit.

Coronavirus “exposed the hybrid model and made people aware of their ability to train at home. But it’s a very additional service to the club”.

Low-cost chains including Basic-Fit and PureGym increased their share of the sector in the decade before the pandemic, but consultancy PwC said in 2019 that numbers could double in the UK to up to 1,400 low-cost gyms.

Increased health concerns and rising prices had fuelled interest in low-cost chains but churn remained a challenge, said Harry Barnick, a senior analyst at research company Third Bridge.

He sees tech as another a way for low-cost gyms to stand out from rivals and draw customers. “As the content offering improves, the level of differentiation between budget and mid-market is narrowing. That could lead to more members exiting mid-market and joining the budgets.”

For more upmarket operators, the focus is on providing a sense of “community with flexibility” through tech, according to Jeff Zwiefel, president and chief operating officer of Life Time Fitness, the high-end US gym chain that went public this year. Like other operators, he said the $15-a-month digital subscription with more than 1,000 live streaming classes that it launched during the pandemic is “here to stay”.

Space for low-cost expansion comes after the pandemic wiped out many small fitness businesses in an industry whose global revenues totalled $96.7bn in 2019. In the US, there were more than 40,000 fitness facilities before the pandemic. By July 2021, more than one in five of those gyms and studios had permanently closed their doors, US trade association the IHRSA found.

In the UK, operators including DW Fitness and Xercise4Less fell into administration last year. Mid-market operator Virgin Active narrowly avoided that fate in May after the High Court approved a restructuring plan under which landlords wrote off its rent arrears.

But since reopening after lockdowns, gym attendance has rebounded. Low-cost US chain Planet Fitness says its membership is at 97 per cent of pre-pandemic levels. The Gym Group, the UK’s only listed gym operator, PureGym and Life Time are also returning to 2019 capacity.

With fitness booming, analysts and operators say there is room to grow. Consultancy Deloitte pointed to the scope for expansion in a recent study of the European gym sector. While 22 per cent of the population are members of clubs in the US, in Europe the figure is only 6.8 per cent and increasing gym membership there from 54.8m to 100m by 2030 is a realistic target it said.

Karsten Hollasch, who compiled the study, said sector consolidation was likely: “Everyone’s in transformation and those with better financing and access to capital markets . . . will collect a few others . . . The big fish will eat the little fish.”

Bigger chains are already seeing opportunity. “There are fewer of us that are well-positioned to take advantage of the rising tide of demand that we expect to see,” said Cobbold said at PureGym’s results last week.

Richard Darwin, chief executive of London-listed The Gym Group has also signalled a “once-in-a-generation opportunity to accelerate growth”, after it raised £31.2m in July to open 40 new sites.

As low-cost gyms become ubiquitous, they are also likely to draw in a wider clientele from mid-market customers who, van der Aar says, “don’t want to pay for things they don’t use — like pools or saunas”.

This could include erstwhile Peloton users such as Jess, who works in banking in Essex and is trying to sell her costly bike: “I’m comfortable and happy with how much I paid but I wouldn’t not go to a cheaper gym.”

Re-energised gyms to muscle in on hybrid post-pandemic fitness sector

Pinoy Variant